Greta Thunberg to World Leaders: 'How Dare You!' - The 16-year-old environmental activist Greta Thunberg scolded heads of state at a United Nations summit on Monday, saying they’re robbing her generation of a future by focusing on money and not on fighting global warming.

Read MoreWe have recently formed an Advisory Board and Investment Committee and appointed KPMG Australia as key advisor for our new Singapore Domicile Master Trust Ultra Impact Fund, UiiSCO, and are currently raising initial USD$50M with a scale-stage portfolio of 6 companies ready to go.

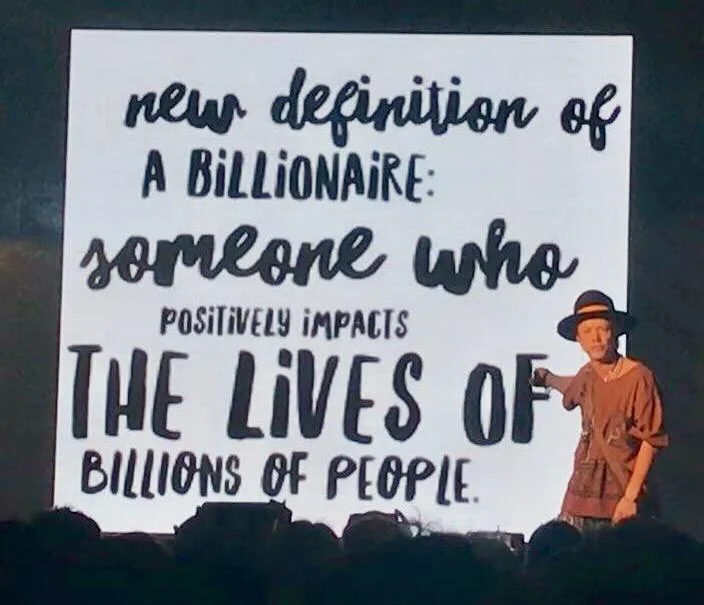

Read More“Why commit to 100% impact investments? To invest in the future we want to create. To protect the commons upon which all life depends. To demonstrate that capital can be deployed with a higher purpose beyond financial return.” – Annie Chen

Read MoreThe Australian government has committed to work in partnership to build the impact investment market to scale.

Read MoreRevving up supply and demand as ‘impact investing’ turns 10 years old. A decade ago, no one had heard of AirBnB, Uber, Spotify, Instagram or Snap. Or “impact investing.” The term was coined, or at least adopted, at a 2007 gathering hosted by the Rockefeller Foundation at their Bellagio retreat center on Lake Como.

Read More“Innovate or die” has been the catchphrase of the 21st century and its applicability extends far beyond the corporate and commercial realm. Not-for-profits also reap the very real benefits of innovation.

One10 and Impact Investment Fund founder Geoff Gourley offers insight into the wide world of innovation strategy and tips for embracing its power.

Read MoreSince the socially aware era of the 1960s the concept of impact investing has been steadily gaining momentum.

Now, a growing body of evidence indicates impact investing has moved well beyond casual philanthropy, hitting the mainstream and offering a very real financial return.

Read MoreIn 2015 the United Nations issued a landmark agenda designed to propel the globe into a more prosperous, sustainable and environmentally friendly future by the year 2030.

Entitled the “Sustainable Development Goals” (SDG), it featured 17 specific goals and 169 targets affecting all counties of the world in a bid to reduce poverty, and increase wellbeing without destroying the earth.

Read MoreStartups and entrepreneurs are a large contributor to new jobs and innovation in Australia. Startups created 1.44 million jobs in our economy between 2006 and 2011 and it’s only continuing to grow.

If you’re an entrepreneur, or an innovative organisation that is just starting out, there’s a high chance you’ll need capital to get the ball rolling.

Read MoreThis article really grabbed our attention, taking a different look at the Impact Investment Spectrum. Here we share an excerpt and link to the full story, which is quite an interesting read.

On July 14th, 2017 a classroom full of private investors were about to learn for the very first time about impact investing in Mexico City. At the very beginning of the class they were asked what were their initial impressions of Impact Investments if any.

Read MoreInvestors hear business pitches all the time. Some that capture their imagination and are highly memorable, and some that are forgotten within the hour. Some businesses you know investors will be clambering to get a piece of, and others they will keep at a distance.

Read MoreMillennials aren’t just eating avocado toast and snapchatting, they’re also driving the growth of a $US9 trillion market on Wall Street: sustainable investing.

Read MoreIn July 2017 our founder, Geoff Gourley, was extremely humbled to be selected in the Top 100 Social Entrepreneurs and Innovators around the world. A list prepared and selected by European-Based Social Enablers called the SE100.

Read MoreEthical fund assets grew 62 per cent in 2015 to $52 billion, shows the latest Responsible Investment Association Australasia (RIAA) Benchmark Report. The sector has doubled in two years as responsible investing redefines the investment landscape.

Read MoreThe creation of “impact classes” as a classification system has the potential to address a number of stubborn barriers in impact investing.

As compelling as the concept of impact investing has become, many investors still remain stymied in their efforts to put capital to work addressing social and environmental challenges.

Read More