Greta Thunberg to World Leaders: 'How Dare You!' - The 16-year-old environmental activist Greta Thunberg scolded heads of state at a United Nations summit on Monday, saying they’re robbing her generation of a future by focusing on money and not on fighting global warming.

Read MoreWe have recently formed an Advisory Board and Investment Committee and appointed KPMG Australia as key advisor for our new Singapore Domicile Master Trust Ultra Impact Fund, UiiSCO, and are currently raising initial USD$50M with a scale-stage portfolio of 6 companies ready to go.

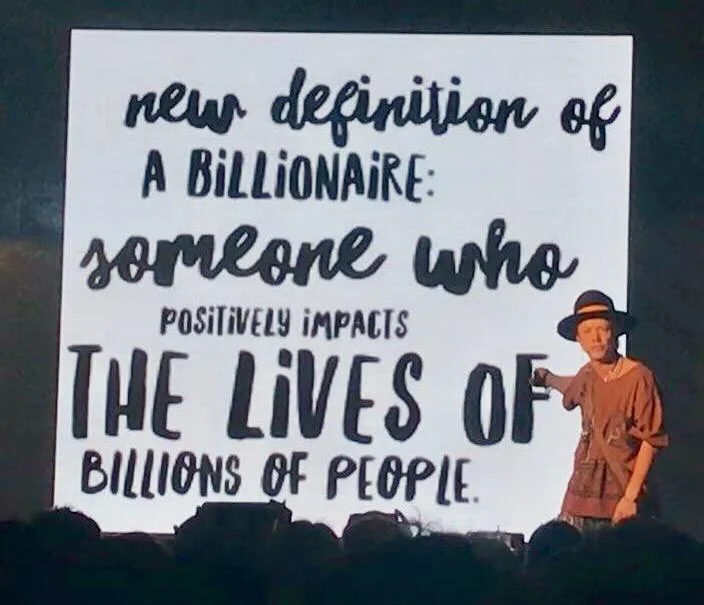

Read More“Why commit to 100% impact investments? To invest in the future we want to create. To protect the commons upon which all life depends. To demonstrate that capital can be deployed with a higher purpose beyond financial return.” – Annie Chen

Read MoreThe Australian government has committed to work in partnership to build the impact investment market to scale.

Read MoreRevving up supply and demand as ‘impact investing’ turns 10 years old. A decade ago, no one had heard of AirBnB, Uber, Spotify, Instagram or Snap. Or “impact investing.” The term was coined, or at least adopted, at a 2007 gathering hosted by the Rockefeller Foundation at their Bellagio retreat center on Lake Como.

Read MoreSince the socially aware era of the 1960s the concept of impact investing has been steadily gaining momentum.

Now, a growing body of evidence indicates impact investing has moved well beyond casual philanthropy, hitting the mainstream and offering a very real financial return.

Read MoreThis article really grabbed our attention, taking a different look at the Impact Investment Spectrum. Here we share an excerpt and link to the full story, which is quite an interesting read.

On July 14th, 2017 a classroom full of private investors were about to learn for the very first time about impact investing in Mexico City. At the very beginning of the class they were asked what were their initial impressions of Impact Investments if any.

Read MoreMillennials aren’t just eating avocado toast and snapchatting, they’re also driving the growth of a $US9 trillion market on Wall Street: sustainable investing.

Read MoreEthical fund assets grew 62 per cent in 2015 to $52 billion, shows the latest Responsible Investment Association Australasia (RIAA) Benchmark Report. The sector has doubled in two years as responsible investing redefines the investment landscape.

Read MoreThe creation of “impact classes” as a classification system has the potential to address a number of stubborn barriers in impact investing.

As compelling as the concept of impact investing has become, many investors still remain stymied in their efforts to put capital to work addressing social and environmental challenges.

Read MoreYou’ve just heard about your friend’s new business venture. He’ll be selling simple canvas shoes for a reasonable price and using a portion of the profits to provide shoes to children who cannot afford them.

Read More